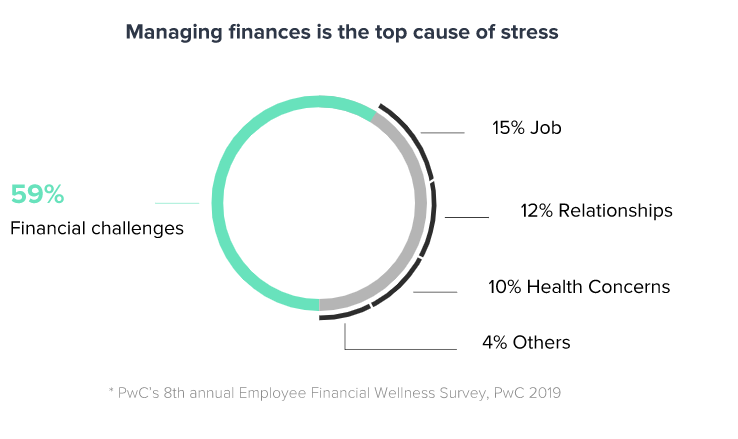

Managing finances is the top cause of employee stress in 2019, as revealed by PWC’s Employee Financial Wellness Survey. You might not think that this is a problem for your business, that your employees are compensated fairly and that managing their finances is a personal issue. However, a number of studies in the last few years have revealed a significant link between financial stress and employee performance, leading to increased absenteeism, decreased productivity and higher health care costs.

Increased absences

According to SHRM, financial stress among employees causes a 34% increase in absenteeism and tardiness. When staff miss days due to financial issues, not only is it a problem for the business as it leads to a decline in output, but it is also a huge concern for the employee, and the burden that is causing their inability to attend work.

Lower productivity

A knock-on effect of this is a significant decrease in productivity, due to distracted employees whose minds are elsewhere dealing with their financial issues. This can often lead to an inability to focus and be present at work.

Higher healthcare costs

We know that stress has a direct link to health, and can be the root cause of many illnesses. With stressed employees at a higher risk of needing healthcare and treatment, this means that their health insurance is more frequently used, therefore driving up the cost of your group health premium. The health and welfare of employees should be top of mind for any employer, to ensure the positive effects of physical, mental and financial wellness on a business.

The consequence of this is that only 44% of employees surveyed believe that their employer cares about their financial wellbeing (PWC, 2019). There can often be a stigma around discussing finances and approaching salary conversations with management, and what is surprising perhaps is when surveyed about desired employee benefits for 2020, one in four employees requested a financial wellness benefit. Of companies that do currently offer a financial wellness benefit, 71% of employees have used the benefit.

At Bayzat, we want employees in the region to be happy and productive, and experience positive financial wellness. We aim to create a world-class employee experience for every SME in the UAE. That’s why we have just launched EarlyPay, enabling you to provide a much-needed financial wellness benefit to your employees, at no cost to you. EarlyPay users can simply elect to receive a portion of their salary in advance, for a very small fee, and receive the money instantly into their account. This gives them greater flexibility to manage their finances and alleviates the need for credit cards and overdrafts, reducing the risk of getting into debt.

To find out more about activating EarlyPay for your team, contact us today.

Get Social