Whether you are new or have been living in Dubai for the longest time, you know most of your financial stress comes from high costs of buying and maintaining a new car or renting a house. And in a time of financial crisis, where many are losing their jobs everyday or have to put up with salary cuts, it’s important to be cautious of your expenses. While buying a new car is often common in Dubai, being the highest in the region with 540 cars per thousand people, it might not be the most financially smarter option as it comes with high costs.

But new car ownership is a really important milestone for some people. Although the used car market is a great place to look at in terms of a more financially convenient option, people prefer to buy a new car as there are uncertainties that come with getting a used car. In addition, there is a certain level of comfort in driving a new car with servicing and powertrain under warranty from the manufacturer for a period of time.

Yet considering the personal value you get from buying a new car, it is still important to keep in mind the different costs associated with purchasing a new automobile and decide on what can be most convenient for you financially.

The most commonly driven car in the UAE is the Toyota Corolla. As an example of what your cost would approximately be, below is a simple breakdown of the most important costs associated with owning a new 2018 Corolla, costing around AED 71,900 as advertised by the dealership:

| 20% down payment | AED 14,180 (one-time payment) |

| Monthly payments/installments for a five year payback plan | AED 980 |

| Extra costs | – Comprehensive insurance: AED 3,000 to 4,000 – Registration costs such as annual inspection fees: AED 1,000 – Cleaning, maintenance, and servicing costs: AED 1,000 – Salik Registration: AED 100 (if registered online, the cost is AED 120) – Total salik and fuel cost (estimated by current cost per liter): around AED 4,000 to 5,000 per year |

| Yearly total cost | around AED 20,800 (excluding the down payment) |

For an economical car such as the Toyota Corolla, the monthly cost is not that steep. And given that you’re paying more in the short term, it means you can be paying less in the long term, soon after your initial payments. Additionally, you always have the option to sell the car any time you need to.

But keeping in mind the expenses above, it is also important to note that some of the costs like insurance can vary. When budgeting for the year, it is worthwhile to make a similar chart using the relevant pricing and consider all cost factors to see if it is the right decision; maybe the most convenient option is just to rent a car or buy a used one. Quite often people also forget that there is a 20% down payment, which skews the first payment on the car significantly and requires the buyer to usually save ahead in preparation.

Fuel consumption and Salik top up can also raise the monthly cost of owning a car, depending on the amount of driving the car owner does and the routes that are used. Fuel consumption could vary depending on the proximity of the car owner from work. A full tank of petrol per week is a good average barometer to use. In the case of Salik charges, the ceiling of AED 24 per day was recently removed. This can also skew the monthly cost if the car owner uses Sheikh Zayed Road as opposed to the alternative routes which do not charge salik.

Shopping around for the best interest rate offered by banks is also a good way to save some money. Some car manufacturers offer periods of 0% interest on their cars which is a great time to think about buying a car. Keeping an eye on these offers, especially during Ramadan, like free car registration, free insurance for a year, a TV with each purchase or others, can save the consumer a significant amount of money.

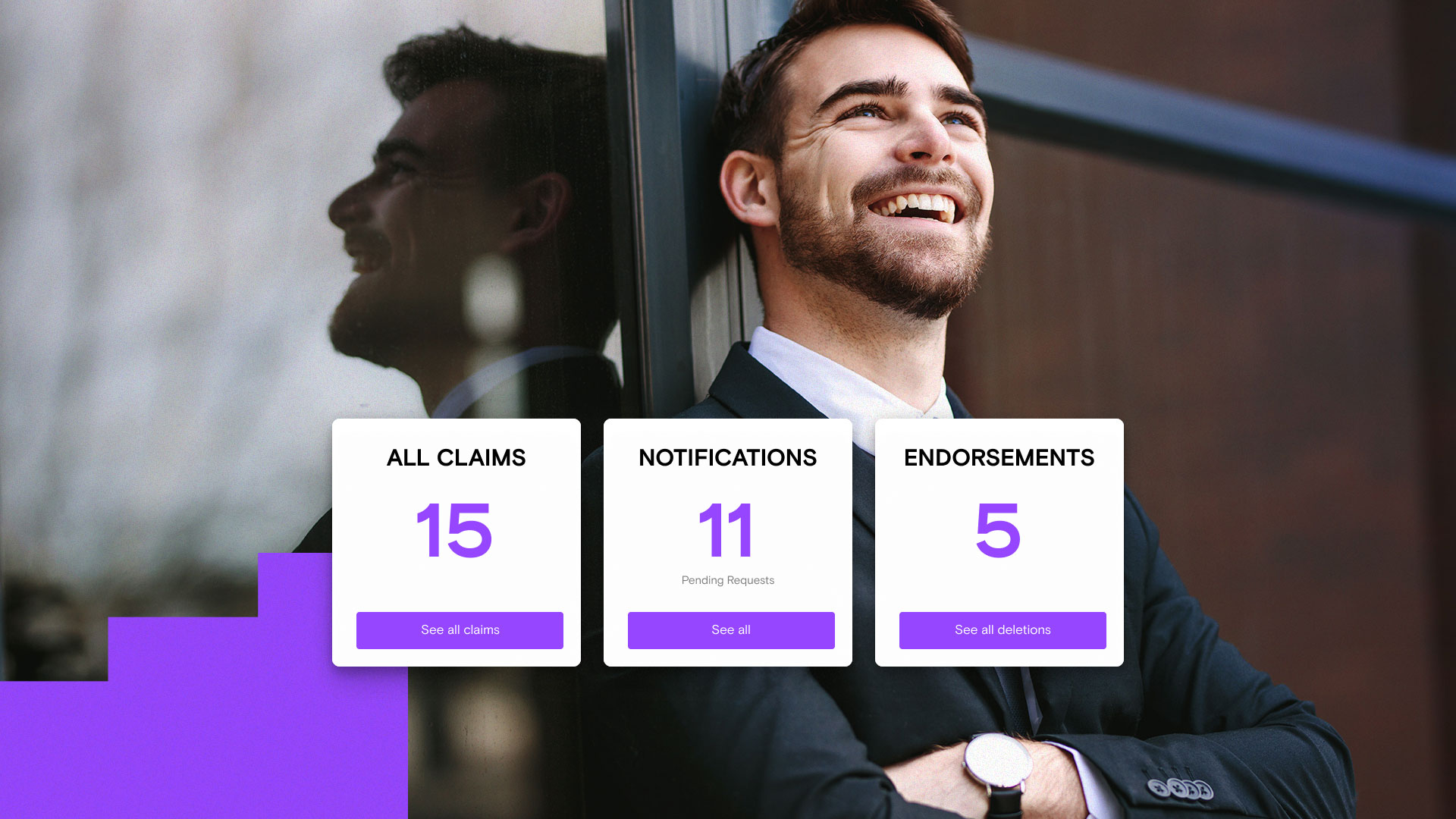

If you are considering in buying a car, Bayzat is just what you need to help analyze your best option financially and ensure to be covered by the right policy for you. Through Bayzat, not only you can compare interest rates for new car loans, but also get interest-free installements from six to nine months, get quotes from the top insurers, and receive support as and when you need it.

Get Social