In the dynamic business landscape of the United Arab Emirates (UAE), one critical aspect of attracting and retaining top talent is having a well-defined and competitive salary structure. A thoughtfully crafted salary structure ensures fairness and transparency, playing a pivotal role in a business’s overall success and growth. This article delves into the intricacies of creating a salary structure tailored to the unique characteristics of the UAE market.

Understanding the UAE Labor Market

UAE is known for its robust economy, with several industries thriving there. Most especially, it is known for the oil and gas industry.

The UAE oil and gas industry is a standalone sector of its economy as it has significantly impacted the economy’s growth. UAE’s economy also has tourism as a major contribution to its economy, with technology and construction following suit.

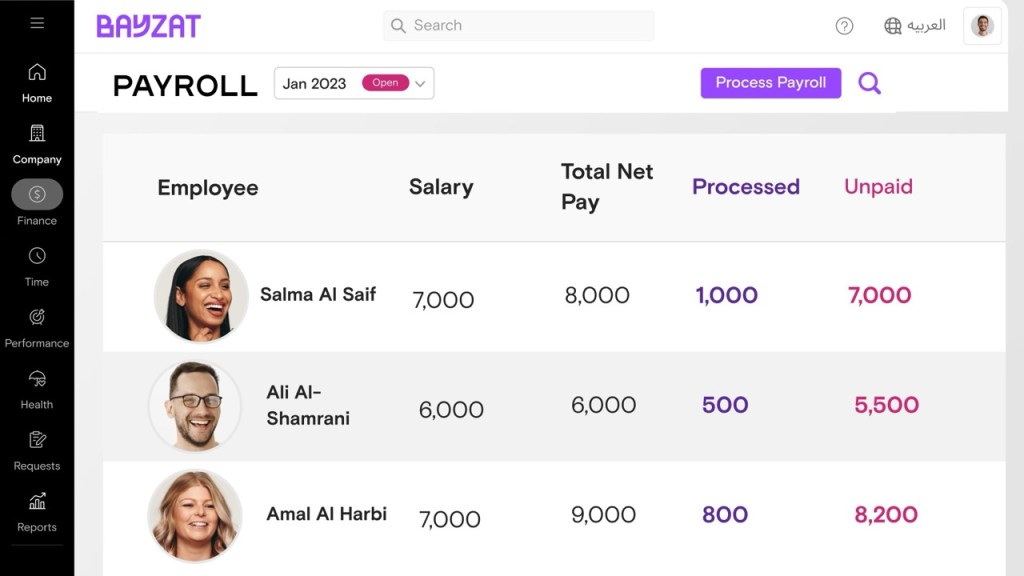

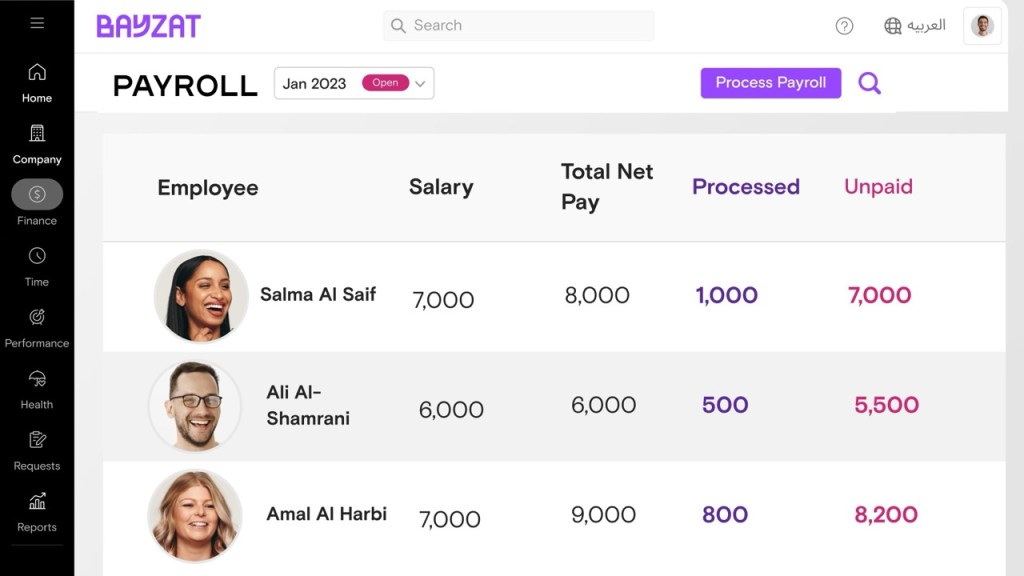

Because of the diversity in the UAE market, there is a varying salary structure. Hence, an efficient payroll system is needed to make payment seamless for all.

Labor Laws and Regulations

UAE labor laws and regulations are governed by Federal Decree-Law No. 33 of 2021, also known as the UAE Labour Law. The law applies to all UAE employees working in the private sector. It outlines several provisions related to employment contracts, leaves, compensations, and terminations, amongst others. It also provides a salary structure for private companies.

Some key provisions of the UAE Labour Law include:

- Minimum wage: The law gives a minimum wage for employees, which must be included in the salary structure.

- Annual Leave: The law states that employees must have a minimum of 30 days leave, which must be included in their salary structure

- Overtime pay: The law requires employers to compensate employees who work beyond regular hours in monetary terms.

- End-of-service benefits: The law mandates employers to provide them to employees who have completed at least one year of service in their company.

- Notice period: The law specifies the notice period for terminating employment contracts, which must be included in the salary structure.

It is important that companies comply with the labor laws when designing a salary structure in the UAE. Complying with labor laws allows for fair employee compensation, prevents labor disputes, and improves the employer’s reputation and brand. Failure to do so can attract fines and legal actions.

Benchmarking and Market Research

When companies in the UAE want to ensure fair payment among employees, they consider companies’ “fair compensation”. This general consideration of companies’ compensation is called benchmarking.

The purpose of benchmarking is simple: to ensure that companies don’t overpay or underpay for labor. Benchmarking also makes it easy for companies to offer competitive pay to retain top talents.

Some successful companies in the UAE, like Emirates Airlines and Dubai Islamic Bank, have used benchmarking to decide how much to pay their employees. It has also helped them attract talented employees, which is important for their success.

Local vs. International Talent

The difference in salary structure between local and international talents is based on citizenship. Locals and citizens of the country receive higher salaries, social security as a special benefit, and a bonus when they leave their jobs after five years.

On the other hand, foreign workers(who are not citizens) receive lesser salaries, no social security as a special benefit, and a bonus when they leave their jobs after a year. Some companies rarely provide them with a free flight home.

Components of a Salary Structure

A base salary is a fixed monthly amount an employee receives as monetary compensation for labor. It is different from the additional forms of compensation employees receive. There is no fixed amount for base salary, as different factors can influence it, some of which are qualifications and industry standards.

For instance, a marketing manager with five years of experience will have a higher base salary than a marketing manager with two years of experience. The same applies to marketing managers working with high-paying companies. So, Industry standards matter, too.

That said, the standard practice in the UAE is salary ranges—a salary band. A salary band is used to determine base salaries for a specific job or position. For instance, a company might have a salary band of AED 8,000 to 12,000 per month for a customer service representative, depending on the employee’s experience and qualifications.

Check out some salary bands and ranges used in the UAE market:

- Customer Service Representative: AED 8,000 – 12,000 per month

- Marketing Manager: AED 15,000 – 20,000 per month

- Software Engineer: AED 12,000 – 18,000 per month

- Human Resources Manager: AED 18,000

Benefits and Perks

A common practice in several companies is using housing allowances to attract top talent. Housing allowances help employees cover the cost of living in the country, especially in high-cost areas. Another attractive bonus for top talents is healthcare. Companies in the UAE offer subsidized healthcare to their workers in the same way they offer discounted transportation costs.

Some companies go beyond this and offer extra packages to their employees. For example, enhanced maternity and paternity leaves to help married employees balance work and family life.

Case studies show that companies that offer innovative benefits packages are more successful in retaining top talent. For example, a company offering part-time opportunities or emotional counseling services may appeal more to employees who value work-life balance. Similarly, a company that provides financial health checks will be more attractive to employees who prioritize financial security.

Performance-Based Compensation

Performance-based compensation involves rewarding employees based on their input into the company’s success. It is a way of encouraging employees to work harder by attaching bonuses and incentives to performance.

Research shows that performance-based compensation greatly influences employee motivation. In fact, a survey in the UAE found that more than 80% of employees feel motivated when bonuses are tied to their performances.

Emirates Airlines and Dubai Islamic Bank have recorded great success using performance-based bonuses. Emirates, for one, does this a little differently by using a profit-sharing scheme that distributes a percentage range of the profits to employees based on their performance.

Communicating the Salary Structure

Transparency is key in salary structure. Companies that are transparent about their bonuses and salary structure build trust and credibility with their employees. The same goes for companies that constantly update their employees on changes in salary structure.

Transparency in salary structure eliminates employee confusion and helps promote equity and fairness in the company.

Examples of companies with transparent compensation practices in the UAE are Emaar Properties, the developer of Burj Khalifa, and Etisalat, the largest UAE telecom company.

Employee Education

Employee education involves teaching employees how to calculate their salary and how it relates to their career growth. To begin this process, companies can organize training sessions that explain employee emotions. Employees should also be encouraged to ask questions and discuss any misunderstandings.

It is imperative to mention that employees’ education includes informing employees of policy changes or salary structure changes.

Create a Salary Structure with Bayzat

Creating a salary structure for UAE businesses is a multifaceted endeavour that requires a deep understanding of the local labor market, meticulous research, and a commitment to fairness and transparency. A well-designed salary structure attracts top talent and ensures employee satisfaction and retention, contributing to long-term business success. As the UAE continues to evolve as a global business hub, staying ahead in the compensation game is essential for any organization aspiring to thrive in this environment.

Frequently Asked Questions

How Does the UAE’s Labor Law Impact Salary Structures, and What are the Legal Requirements for Employers?

The UAE’s labor law sets the rules for salary payments, leave, and working hours. It ensures that employees’ salary structure complies with the law. It also gives provision for paying health insurance and employee time off.

What are the common salary components in the UAE, and how do they vary across industries?

The common salary component in UAE is the basic salary, which consists of a base salary and other components like housing allowance and transportation bonuses.

What is the Average Salary Increase Percentage in the UAE, and How Often Should Companies Review and Adjust Their Salary Structures?

The average salary increase in the UAE is around 5-10% per year. Companies review and adjust their salary structures every 6-12 months.

How Do Companies in the UAE Handle Salary Negotiations With Employees?

UAE companies handle salary negotiations transparently. Their strategy for managing employees’ expectations includes clearly communicating values and offering alternative benefits.

What are The Tax Implications of Salary Structures in the UAE, and How do Companies Need to Consider Tax laws When Designing Their Compensation Packages?

The UAE has no income tax, but companies must consider social security contributions when designing compensation packages. They must also comply with tax laws and regulations when paying salaries and benefits.

In the dynamic business landscape of the United Arab Emirates (UAE), one critical aspect of attracting and retaining top talent is having a well-defined and competitive salary structure. A thoughtfully crafted salary structure ensures fairness and transparency, playing a pivotal role in a business’s overall success and growth. This article delves into the intricacies of creating a salary structure tailored to the unique characteristics of the UAE market.

Understanding the UAE Labor Market

UAE is known for its robust economy, with several industries thriving there. Most especially, it is known for the oil and gas industry.

The UAE oil and gas industry is a standalone sector of its economy as it has significantly impacted the economy’s growth. UAE’s economy also has tourism as a major contribution to its economy, with technology and construction following suit.

Because of the diversity in the UAE market, there is a varying salary structure. Hence, an efficient payroll system is needed to make payment seamless for all.

Labor Laws and Regulations

UAE labor laws and regulations are governed by Federal Decree-Law No. 33 of 2021, also known as the UAE Labour Law. The law applies to all UAE employees working in the private sector. It outlines several provisions related to employment contracts, leaves, compensations, and terminations, amongst others. It also provides a salary structure for private companies.

Some key provisions of the UAE Labour Law include:

- Minimum wage: The law gives a minimum wage for employees, which must be included in the salary structure.

- Annual Leave: The law states that employees must have a minimum of 30 days leave, which must be included in their salary structure

- Overtime pay: The law requires employers to compensate employees who work beyond regular hours in monetary terms.

- End-of-service benefits: The law mandates employers to provide them to employees who have completed at least one year of service in their company.

- Notice period: The law specifies the notice period for terminating employment contracts, which must be included in the salary structure.

It is important that companies comply with the labor laws when designing a salary structure in the UAE. Complying with labor laws allows for fair employee compensation, prevents labor disputes, and improves the employer’s reputation and brand. Failure to do so can attract fines and legal actions.

Benchmarking and Market Research

When companies in the UAE want to ensure fair payment among employees, they consider companies’ “fair compensation”. This general consideration of companies’ compensation is called benchmarking.

The purpose of benchmarking is simple: to ensure that companies don’t overpay or underpay for labor. Benchmarking also makes it easy for companies to offer competitive pay to retain top talents.

Some successful companies in the UAE, like Emirates Airlines and Dubai Islamic Bank, have used benchmarking to decide how much to pay their employees. It has also helped them attract talented employees, which is important for their success.

Local vs. International Talent

The difference in salary structure between local and international talents is based on citizenship. Locals and citizens of the country receive higher salaries, social security as a special benefit, and a bonus when they leave their jobs after five years.

On the other hand, foreign workers(who are not citizens) receive lesser salaries, no social security as a special benefit, and a bonus when they leave their jobs after a year. Some companies rarely provide them with a free flight home.

Components of a Salary Structure

A base salary is a fixed monthly amount an employee receives as monetary compensation for labor. It is different from the additional forms of compensation employees receive. There is no fixed amount for base salary, as different factors can influence it, some of which are qualifications and industry standards.

For instance, a marketing manager with five years of experience will have a higher base salary than a marketing manager with two years of experience. The same applies to marketing managers working with high-paying companies. So, Industry standards matter, too.

That said, the standard practice in the UAE is salary ranges—a salary band. A salary band is used to determine base salaries for a specific job or position. For instance, a company might have a salary band of AED 8,000 to 12,000 per month for a customer service representative, depending on the employee’s experience and qualifications.

Check out some salary bands and ranges used in the UAE market:

- Customer Service Representative: AED 8,000 – 12,000 per month

- Marketing Manager: AED 15,000 – 20,000 per month

- Software Engineer: AED 12,000 – 18,000 per month

- Human Resources Manager: AED 18,000

Benefits and Perks

A common practice in several companies is using housing allowances to attract top talent. Housing allowances help employees cover the cost of living in the country, especially in high-cost areas. Another attractive bonus for top talents is healthcare. Companies in the UAE offer subsidized healthcare to their workers in the same way they offer discounted transportation costs.

Some companies go beyond this and offer extra packages to their employees. For example, enhanced maternity and paternity leaves to help married employees balance work and family life.

Case studies show that companies that offer innovative benefits packages are more successful in retaining top talent. For example, a company offering part-time opportunities or emotional counseling services may appeal more to employees who value work-life balance. Similarly, a company that provides financial health checks will be more attractive to employees who prioritize financial security.

Performance-Based Compensation

Performance-based compensation involves rewarding employees based on their input into the company’s success. It is a way of encouraging employees to work harder by attaching bonuses and incentives to performance.

Research shows that performance-based compensation greatly influences employee motivation. In fact, a survey in the UAE found that more than 80% of employees feel motivated when bonuses are tied to their performances.

Emirates Airlines and Dubai Islamic Bank have recorded great success using performance-based bonuses. Emirates, for one, does this a little differently by using a profit-sharing scheme that distributes a percentage range of the profits to employees based on their performance.

Communicating the Salary Structure

Transparency is key in salary structure. Companies that are transparent about their bonuses and salary structure build trust and credibility with their employees. The same goes for companies that constantly update their employees on changes in salary structure.

Transparency in salary structure eliminates employee confusion and helps promote equity and fairness in the company.

Examples of companies with transparent compensation practices in the UAE are Emaar Properties, the developer of Burj Khalifa, and Etisalat, the largest UAE telecom company.

Employee Education

Employee education involves teaching employees how to calculate their salary and how it relates to their career growth. To begin this process, companies can organize training sessions that explain employee emotions. Employees should also be encouraged to ask questions and discuss any misunderstandings.

It is imperative to mention that employees’ education includes informing employees of policy changes or salary structure changes.

Create a Salary Structure with Bayzat

Creating a salary structure for UAE businesses is a multifaceted endeavour that requires a deep understanding of the local labor market, meticulous research, and a commitment to fairness and transparency. A well-designed salary structure attracts top talent and ensures employee satisfaction and retention, contributing to long-term business success. As the UAE continues to evolve as a global business hub, staying ahead in the compensation game is essential for any organization aspiring to thrive in this environment.

Frequently Asked Questions

How Does the UAE’s Labor Law Impact Salary Structures, and What are the Legal Requirements for Employers?

The UAE’s labor law sets the rules for salary payments, leave, and working hours. It ensures that employees’ salary structure complies with the law. It also gives provision for paying health insurance and employee time off.

What are the common salary components in the UAE, and how do they vary across industries?

The common salary component in UAE is the basic salary, which consists of a base salary and other components like housing allowance and transportation bonuses.

What is the Average Salary Increase Percentage in the UAE, and How Often Should Companies Review and Adjust Their Salary Structures?

The average salary increase in the UAE is around 5-10% per year. Companies review and adjust their salary structures every 6-12 months.

How Do Companies in the UAE Handle Salary Negotiations With Employees?

UAE companies handle salary negotiations transparently. Their strategy for managing employees’ expectations includes clearly communicating values and offering alternative benefits.

What are The Tax Implications of Salary Structures in the UAE, and How do Companies Need to Consider Tax laws When Designing Their Compensation Packages?

The UAE has no income tax, but companies must consider social security contributions when designing compensation packages. They must also comply with tax laws and regulations when paying salaries and benefits.

Abdelkarim Aridj

A seasoned Digital Marketer and a Content Marketing Strategist. When he isn't working, he spends his free time cycling, and hiking.

Get Social