Payroll management can take a lot of time. You need to process the hours, special time-off, work-related expenses and many more for various workers, from part-time to full-time. In the UAE, companies have to further remember to comply with local labour laws and the WPS system. Doing everything manually can take a lot of time. The solution is to pick the best payroll software in UAE and enjoy the benefits of cloud-based, automated systems. The right way to make use of technology is to understand what it does. Your business can enjoy the full benefits of payroll software if you know what these systems bring.

What is Payroll Software?

The definition of Payroll Software is that it automates to process of paying employees and their related tasks in the organizations. The system manages, maintains, and automates the payments, whether weekly or monthly. You can configure the software to maintain compliance with tax and other employment regulations. The software would maintain full compliance with regional laws for a UAE business payroll. At its core, you simplify your payroll processing.

Modern payroll software in UAE is often cloud-based, meaning the system isn’t a physical piece of hardware on your company’s computers. But there are also on-site solutions available.

How do payroll systems work?

Payroll software integrates with your business systems. The system takes in employee information, from personal details to payment preferences. Your HR and finance team can then manage payment information, including salary information and contract types. The system automates calculating accurate pay and makes the payments on your team’s behalf.

The benefits of payroll software

Payroll software helps your team manage the often-tedious payroll schedule. Relying on the software to do it for you can provide teams with many benefits. These include:

- Time-saving: Payroll software helps reduce the time burden of tracking payment information. Your HR team can focus on other, more pressing matters.

- Accuracy: The software reduces the risk of human errors that are bound to happen. Your payment information will be detailed and correct, saving you money by limiting costly mistakes.

- Transparent – Payroll management software guarantees both your HR team and employees have access to data and the ability to view the details.

- Compliant – Payroll software can review local laws and regulations, ensuring you follow all the requirements.

- Cost-effective – Many of these benefits lead your business to save money. Your HR department can streamline its functions and focus on the more crucial and costly problems. Reduction in errors and compliance issues will save money as well.

The above benefits are a significant reason small and big businesses look for payroll software. The technology can help keep data safe, and choosing the right software can boost business performance.

In addition, having a smoothly running payroll processing system can improve work morale. Employees don’t want to face issues with salary. If you pay salaries accurately and on time, your employees will be happier.

The Importance of Payroll Software in the UAE

Efficient payroll management for UAE companies is vital. UAE business payroll can be complex, as regional companies often have unique payroll conditions. The international business environment means your business deals with employees worldwide, often in individual contracts, from hourly to permanent.

The legal complexities within UAE mean that the region doesn’t:

- Have a minimum payable salary.

- Article 19 of the UAE Labor law rules regarding overtime states that employees are entitled to remuneration.

- UAE Gratuity is accrued against the last drawn basic salary, and the specific times for having to pay graduation are set in Article 132 of the UAE Labor law.

- Subject to payroll to income tax, mandatory tax deductions do not exist.

- UAE nationals are subject to mandatory national pension plan contributions.

Choosing the right software can help ensure you don’t complicate the payroll further. You can manage the different contracts and compliance issues without problems. You will ensure your data is safe, and by integrating it with other systems, you can maintain many HR functions at once. For example, you can ensure healthcare coverage is looked after along with the payroll.

Another critical element of the UAE payroll comes from WPS, which stands for Wage Protection System. It has been part of the law since 2009, with regular tweaks. The electronic wages transfer system oversees payroll payments in the UAE. All UAE companies must upload their Salary Information Files, with the Central Bank of UAE confirming and validating the data.

The system requires payroll compliance, and the right software can ensure that your business takes care of the issues with the system. Your software can help register for WPS and provides the data automatically forwarded to the relevant authorities.

Another benefit for local companies is the data payroll processing can provide. UAE companies are competing with each other and global companies. With a sound payroll system, the data you get and automated reports can help streamline your payroll system further. You learn more about your workers and get information on performance reviews. These can improve your performance management and improve hiring and onboarding procedures.

Factors to Consider When Choosing Best Payroll Software for Your Business

The benefits of good payroll software in the UAE are hard to ignore. But to get your hands on the advantages, you need to consider a few essential things. Choosing the right software takes a bit of time and effort – it will be worth it in the end, as you can save time and money in the long run!

When you are thinking about finding payroll software, consider the following five factors:

1. Understand your business needs

It all starts with your business. Each industry and business is different. You might employ only part-time workers with a range of contracts, thus requiring more from your software. Another company may only have a single type of contract and no need for some fancier extra features.

Think carefully about what your payroll system looks like at the moment. What are your current needs, and how are they met? What would you like your payroll to perform better or differently? Answering these vital questions can help you direct your search.

2. Consider the size and nature of your business

Software solutions should also fit your business size. There is no point in paying for software aimed at larger businesses with 500 people on the payroll if your organization only employs 20.

But you also need to understand that your size might vary depending on the nature of your business. For example, you might expect to grow your business within the following year. You would want your payroll to adjust to the bigger crew without issues. Scalable payroll software can help do this without paying extra in advance.

3. Learn about the features and functionalities of the software

Different software solutions can have varying functionalities. You should get familiar with what the software offers and then pick a product that aligns with your business objectives. Most software developers have brochures you can request, and you may also talk to a representative to get a clearer picture. It’s important to focus on a few essential factors. You need to:

- Know what the functions and features are

- How these align with your business needs and requirements

- Understand the cost of the software, both in terms of the product, implementation and upkeep cost

- Learn about security and customer service

The final point is incredibly vital. You should always check the security implementation of the software, especially with cloud-based software. You want to ensure the company offers the best protection with solid authentication features to keep your data safe.

You want to get the most information possible when looking into a product. If you feel the developer isn’t responding to your queries, it can be a sign that they won’t provide you with a great product.

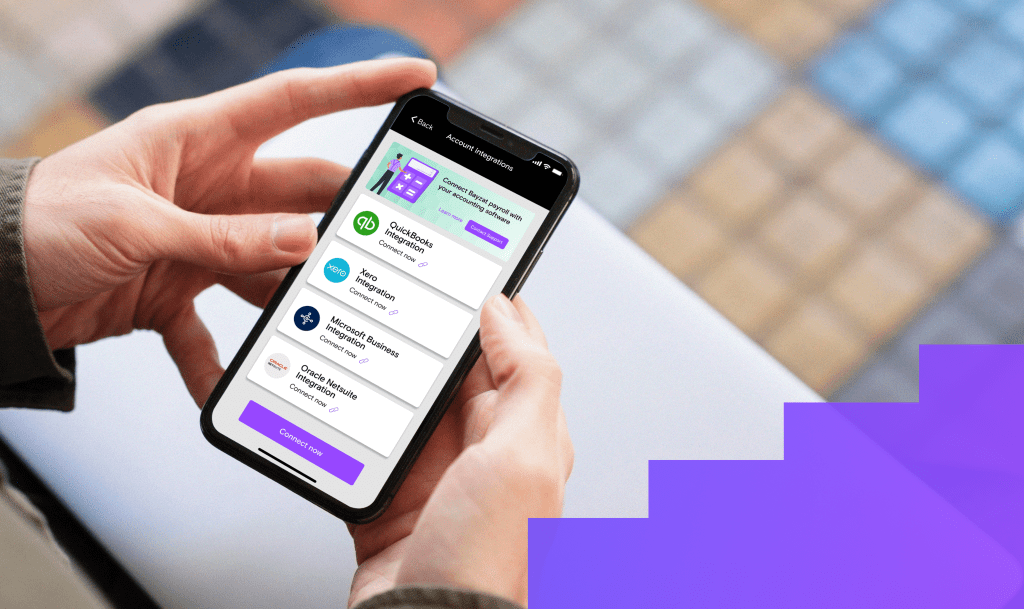

4. Ensure payroll integration with HR software

Running your payroll and accounting as separate entities can be time-consuming and costly. That is why you want to opt for an integrated system. Your payroll software can integrate with different HR tools and accounting programs. These can provide many benefits for the HR and finance departments. You can read more about the systems and their advantages here.

5. Prioritise the software’s compliance with UAE regulations

As mentioned, opting for software that understands the intricacies of the UAE labor laws is essential. There are unique features to consider, and software that’s not compliant can make payroll processing harder, not easier. You want to ensure the software is compliant and that the developers always prioritise compliance. Labor laws can change regularly, and you want your software to stay current.

The Transition from Manual to Automated Payroll Processing

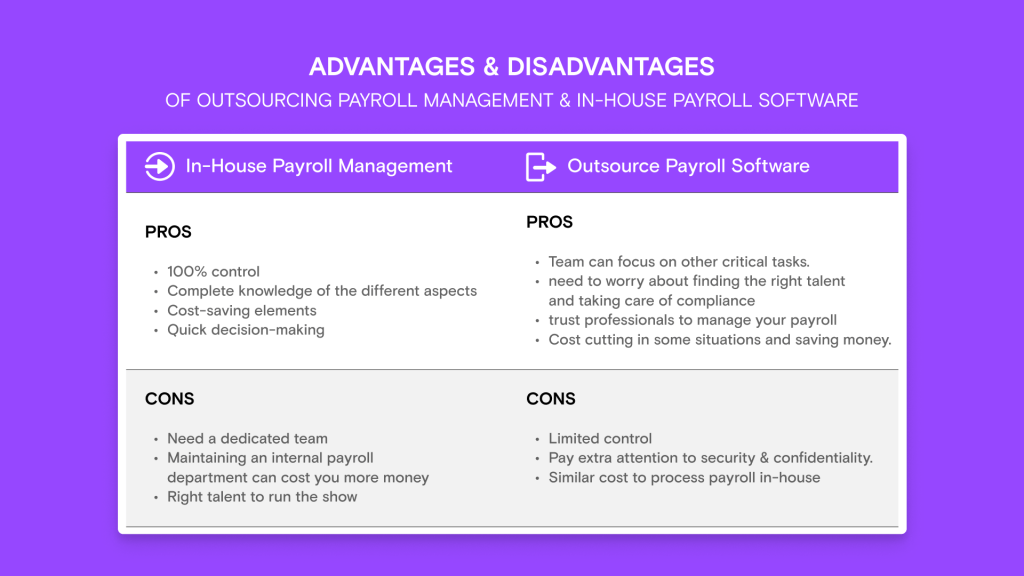

The transition from manual to automated payroll processing can seem daunting. Technological advances happen so fast, and it’s only human to feel a bit of resistance in front of them. So what are the advantages of moving from manual payroll software to automated?

A manual payroll software still requires some level of manual processing. The payroll information often needs to be checked by an individual, and things such as payment processing typically require approval from your team. The practice is faster than without any technology. However, it still takes a lot of time, significantly if your team is growing.

Automated payroll software simplifies this aspect of processing. You reduce the required approval steps, trusting the system to do these calculations and reports for you. Consider that Deloitte research has shown that over 25% of payroll staff spent most of their time running payroll. The time could be better spent elsewhere.

The benefits of automated payroll are similar to those of outsourcing payroll management. Your employees get to focus on more critical tasks. The program handles compliance, meaning you don’t have to worry about the intricate UAE business payroll regulations. You’ll end up saving a lot of money.

The List of Top 10 Payroll Softwares in the UAE

The world is full of HR & Payroll software. However, because payroll is closely connected to local laws and regulations, you need to ensure your chosen product works with the current local laws. To help you narrow down your search for the top payroll software in the UAE, these are ten good software solutions to keep in mind.

- Bayzat

We’re proud to say that Bayzat is one of the most trusted and best payroll software in the UAE. Our a comprehensive payroll management system gives you access to payroll information no matter where you are. The software is fully localized, so you don’t have to worry about any compliance issues with the UAE labor law. The payroll software aligns seamlessly with our core HR software, which makes it easy to boost employee well-being and productivity. You can be guaranteed all the information is safe, as the software is updated with the latest encryption and security protocols with artificial intelligence and machine learning to deliver results.

You can trial our payroll software before committing to it. If you have any questions regarding the features or pricing, you can contact us, and we’ll be happy to help!

The three cornerstones of our payroll are:

- Efficiency: Our software eliminates manual systems, giving you faster access to payroll processing.

- Accuracy: Cloud-based systems help reduce human error, and the intuitive user interface makes it easy to find, manage and view information.

- Security: Keeping your data safe is paramount to us. Our systems are secure, and the cloud-based software uses all the latest security protocols.

The Bayzat’s Payroll system is fully WPS compliant, streamlining your payroll management. Our features include the ability to access, manage and track employee data. You can find salary data in just a few clicks, generating automated payslips for all your employees. You don’t need to manually calculate pay information but can trust our automated systems to do it. The calculations can be adjusted if situations change, and you can see different variations depending on things like sick leave or holiday pay.

The Payroll Accounting Integration is also a great way to update your payroll and bookkeeping accordingly. There is no need for double-checking information, and you can reduce the risk of mistakes. Employees can also add work expenses easily, making it easy to keep track of them. The system will allow you to approve and include the costs in your next pay cycle.

Bayzat’s payroll software comes with these fantastic features:

- Expense management

- payroll Processing & Management

- Time tracking

- Workflow management

- Accounting Integration

- Automated leave requests

- Employee benefit management

- greytHR

GreytHR is a popular HR software vendor. They offer payroll solutions for small and large companies in the UAE. You can add unlimited salary components, and the software is 100% statutory compliant. The employee self-service system is great at reducing the administrative burden from your HR department. You can enjoy risk-free service and take the hassle out of your payroll management.

Basic Feature :

- Payroll processing

- Customized pay-slips

- Payroll reports

- Sage HR

Sage HR is a global HR software vendor that also provides great products for UAE clients. Their innovative payroll platform covers all the basics of expense management. Sage HR has other key functionalities for HR professionals, including leave management and shift scheduling, that align well with the payroll features. The trusted provider also offers great security features so you can be sure sensitive information stays safe.

Basic Feature :

- Expense management

- Automated expense recording

- Payroll reports

- Payment and reimbursement management

- Zen HR

You could also turn your attention to Zen HR. Their cloud-based HR & payroll system offers localized Middle Eastern payroll solutions with a bilingual (English and Arabic) interface. If your business operates with different currencies, the software makes it easy to make salary calculations in different currencies. You also get access to timesheet reports, and the software is fully compliant with local labor laws and regulations.

Basic Feature :

- Salary calculations

- Employee financial reports

- Vacation salary processing

- Paid overtime requests

- Gulf HR

The cloud-based HR software is built with Middle Eastern audiences in mind. The software offers you a unique and simple solution to complex compliance and legislative issues. If you’re operating in different languages, you can also enjoy the different languages the software supports. The Arabic interface also makes the product simple to use, with the modular software design allowing you to scale the payroll management system as your business grows.

Basic Feature :

- Payroll reporting

- Advance payments

- Customized processes

- Automatic compliance updates

- MENA HR

MENA HR is one of the payroll software provider in the UAE. The cloud-based software has all the key features you could want from a payroll management software.

Basic Feature :

- Pay reports

- Customized payroll workflow

- Multiple allowance management

- Connect HR

You can solve many HR pain points with Connect HR. The software vendor has a popular payroll process system that enables smooth wage processing in the UAE region. You will be able to automate salary adjustments, take care of leave requests and get analytics regarding past payment history.

Basic Feature :

- Payroll management

- Payroll reports

- Reimbursement management

- Employee benefits management

- Bamboo HR

Bamboo HR could also offer your business help with the payroll system. The international HR software vendor has a very consistent and popular payroll system that works with small and large companies. You can benefit from some of Bamboo HR’s additional features, such as paid time off compensation schemes and time tracking software.

Basic Feature :

- Automated payroll tasks

- Payroll reports and analytics

- Employee self-service tools

- Emirates HR

Emirates HR is the cloud based HR & Payroll software in the UAE & GCC region. The intuitive software system helps you automate your payroll processing in a few clicks. You can enjoy plenty of features that can easily be scaled according to company needs. You can take advantage of multi-currency payroll features, and you don’t need to worry about any compliance issues. The software also has an impressive set of safety features to ensure your information stays safe at all times.

Basic Feature :

- Expense tracking

- Payroll reports

- Automated salary calculation

- Humantiz

Tackle your payroll processing with Humantiz. The cloud-based platform is simple to use and offers a smooth framework to deal with reimbursement requests. You don’t need to worry about compliance issues, as the software keeps updated with the latest labor laws and regulations in the UAE. The software is relatively easy to use, so it won’t require a lot of setups.

Basic Feature :

- Reimbursement requests

- Multiple pay periods

- Loan and advance payments

- Payroll workflows

- Multi-currency features

Bayzat Case Study – Two Oceans LLC

You can look to a case study to witness the benefits in full. Bayzat has worked with Two Oceans LLC, also known as Candy Hearts, and helped the company improve its employee experiences. In an interview, their HR manager said the team was managing records manually, leading to difficulties and overworked employees.

Sharika Harbhajun told Bayzat how everything from employee information to payslips required a lot of manual labour. If things went wrong or there were enquiries, they had to look for data manually. Their main pain points included tracking visa documents, providing access to employee information and processing payroll.

After implementing Bayzat’s payroll and HR solutions, the team reduced time spent on payroll from 12 hours each month to just one hour! Employees have access to payroll information and insurance benefits, allowing them to manage their data easier.

The Bottom Line

Choosing payroll software in UAE requires a bit of time and effort. But if you know what your company wants from the system, you pay attention to compliance and security and choose software that offers the features that support your needs, and you can enjoy the benefits to full. UAE businesses can save a lot of time choosing software that processes WPS information for you.

Bayzat has provided first-class service to local businesses for years. Our integrated, cloud-based solutions offer you full compliance with local labour laws and help you manage your international workforce with unique payroll needs. Contact us today to learn how we can smoothen your payroll journey!

Get Social