Obligations On Your Business

Following a year of operating your company’s VAT obligations, this may be a good time to assess whether you are managing to the adaptability and cost-effectiveness you aimed for. In this blog, we provide useful frameworks to help you assess and plan to optimize your operating model.

Key Questions to Ask

Assessing and implementing changes to improve compliance may seem unnecessary especially if you have not incurred any penalties. In reality, your business could be still open to potential risks and avoidable costs which may come to light under an FTA audit.

Compliance risks will typically increase subject to company size, nature of business and transactional volumes. For example, large enterprise Tax Groups are more complex to manage and have greater risks and costs to comply. However, they can affect businesses of any size and some review is advised especially as the FTA has issued several clarification notices since January 1st, 2018.

Best practice recommends periodic reviews to identify compliance risks. Ideally, you should be considering the following questions:

- Can we further reduce the cost of managing our VAT obligations?

- Do we have the adaptability to implement changes quickly if the Legislation changes?

- Are we managing these obligations with minimal risks?

- Could we successfully manage an FTA audit?

Assessing Your Capability

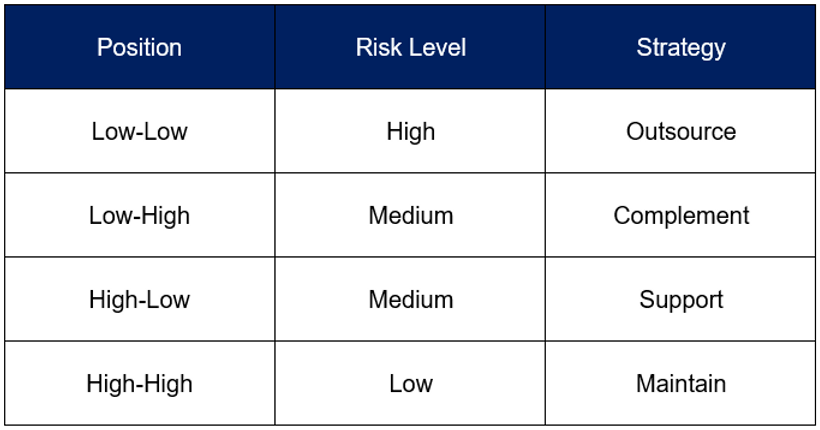

To accurately see what strategy, you should take, the starting point should be to accurately assess your company’s current state and then determine the appropriate approach to meet your goal. Managing effectively is a combination of the VAT expertise available in your business, processes that control your compliance and IT system functionality.

Plotting where you are can help you determine the strategy for the short term and assess your longer-term plan.

In assessing where you are, you should ask the following questions:

- Do you have the trained resources to manage and minimize risks?

- Did you conduct a business-wide VAT assessment and implement changes?

- Do you have the processes and governance (if required) to deal with issues and adapt to new requirements?

- Is your IT set up correctly to manage your end to end VAT compliance & reporting?

- Is your reporting process efficient?

- Is your system fully auditable to provide information and data in case of an audit and generate an FTA Audit File?

Once you have assessed your current capability, the next decision is to evaluate the required impacts to attain your desired target. The longer changes take to implement, the greater the disruption and scope of issues to manage.

Hence, speed is an important factor in setting your targeted objectives and this is dependent on the nature of your business. A services business with a small volume of transactions will imply smaller impacts versus a multi-entity tax group, without a central tax function and separate IT applications.

These illustrative options present a broad summary of strategies available.

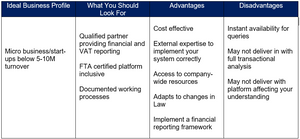

1. Outsource

If your business lacks any platform, trained internal expertise or processes and is seeking a cost-effective solution, outsourcing presents the most viable and simplest option. In doing so, care should be taken in selecting the correct partner as you are fully reliant on their determination on your returns and obligations.

Ensure you have the ability to understanding their deliverables and they are available to support you over the long term. You may require their help in case of FTA queries or audits.

Ideally, a platform inclusive service provider delivers the greatest transparency and longer-term solution to manage your compliance cost-effectively. The additional benefit being you can implement sustainable financial management and insource at a later stage.

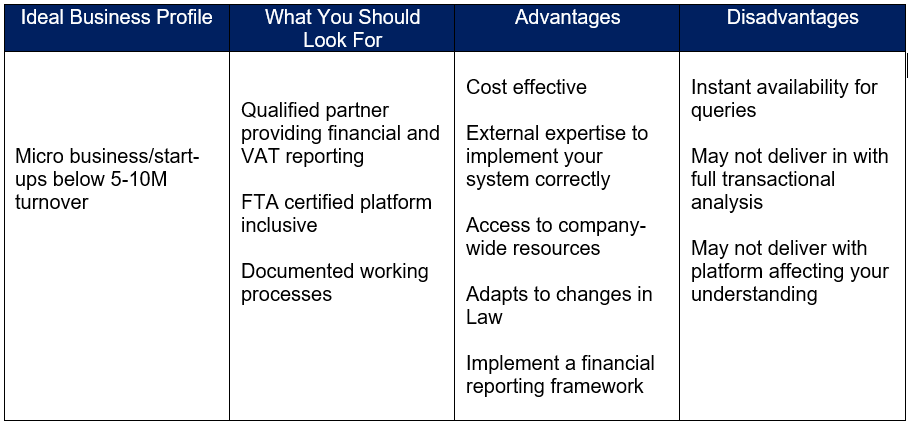

2. Complement

IT plays a pivotal role in minimizes costs and risks through implementing an effective automated system that minimizes human errors and selects the correct treatment at the time of transaction.

You may be an established business with legacy systems and historical financial reporting in place. Updating or changing your accounting application could be complex and budget intensive to meet the full compliance requirements. This transformation may also be difficult to justify purely for VAT requirements and fail your business case.

However, there are a variety of solutions that will co-exist with your existing application. They can present viable options and provide the flexibility and speed your finance team requires to manage their responsibilities. Some providers also provide the VAT expertise to validate your returns for greater assurance.

IT support will be essential for this option to ensure data is available from your core system reliably and on time.

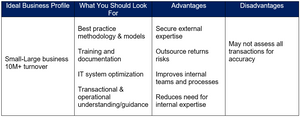

3. Support

If you identify gaps in your internal human capital and processes, securing external support to provide additional best-practice expertise and training can allow you to better operate your processes and platform.

Alternatively, you may choose to retain a partner to prepare your returns. If so, care must be taken to ensure all your transactions are assessed and not sample-based. If all your transactions are not fully assessed, you may file incorrect returns and miss areas of improvement.

A transactional validation tool is one of the options to also include with this strategy. These tools verify postings to a reference set of transactional tax codes and identify posting errors and ratings to reduce miscalculations and reporting errors.

4. Maintain

Positive answers to all the questions assessing your capability place you in a strong position. Maintaining your performance should be your goal and this also usually means an on-going review of legislation changes and market best practices is taken to stay on top.

For finances teams that operate a complete in-house model, it can be a time-consuming process to review all transactions. It is likely transactional miscoding for tax treatment occur in any business which needs to be identified and corrected.

Therefore, the use of a transactional validation tool can reduce manual checking, improve accuracy and speed your VAT preparation cycle.

Disclaimer:

This paper blog is authored by Haroon Juma, Managing Director of SimplySolved Accounting & Tax Solutions.

SimplySolved is ISO 9001 accredited and FTA Tax Agent providing quality driven services in accounting, consulting, Tax, HR, ERP and software implementation as a trusted partner to clients spanning multiple industries.

Our innovative and proven modular services are designed to enable individuals and businesses of all sizes, including Large Enterprise Tax Groups, to cost-effectively manage their financial, tax, HR and IT business processes to higher levels of efficiency and performance.

For further information and assistance, he can be contacted at

Web: simplysolved.ae Email: info@simplysolved.ae

Please note, this document is provided for information purposes only. While every care has been taken to ensure accuracy, SimplySolved does not guarantee that it is free from error or omission.

You cannot rely on this document to cover specific situations; we recommend that you obtain professional advice before acting or refraining from acting on any of the contents of this publication.

Get Social