What is the Talent Lifecycle? The 5 Stages Explained

A company hoping to succeed must have properly mapped out goals and the right talents to achieve them. This particular reason is why businesses must prioritize proper employee management by exploiting the talent lifecycle model [...]

Most Read

Every company wants to secure the best talent to drive its operations and innovations forward, especially in today’s competitive business environment. In the UAE, this quest for top talent is […]

HR Business Partners are one of the most sought-after professionals by UAE big firms. The strategic role has become increasingly indispensable in recent years, with its average remunerations also improving. […]

Applicant Tracking Systems (ATS) has been around since the 1990s, helping organizations and companies employ workers for relevant job openings. The emergence of ATS software in the 2000s made the […]

We are in an era of rapid technological advancements. Every workplace is experiencing a massive shift, and with the entry of generative AI, automation and AI integration are faster than […]

When hiring new employees, every role within an organization calls for a unique blend of different competencies. These could be anything from hard skills to soft skills, and behavariol attributes […]

As an HR professional, you are constantly faced with a range of tasks and responsibilities that can sometimes feel like an ever-expanding monster. Urgent tasks pile up, demanding immediate attention, […]

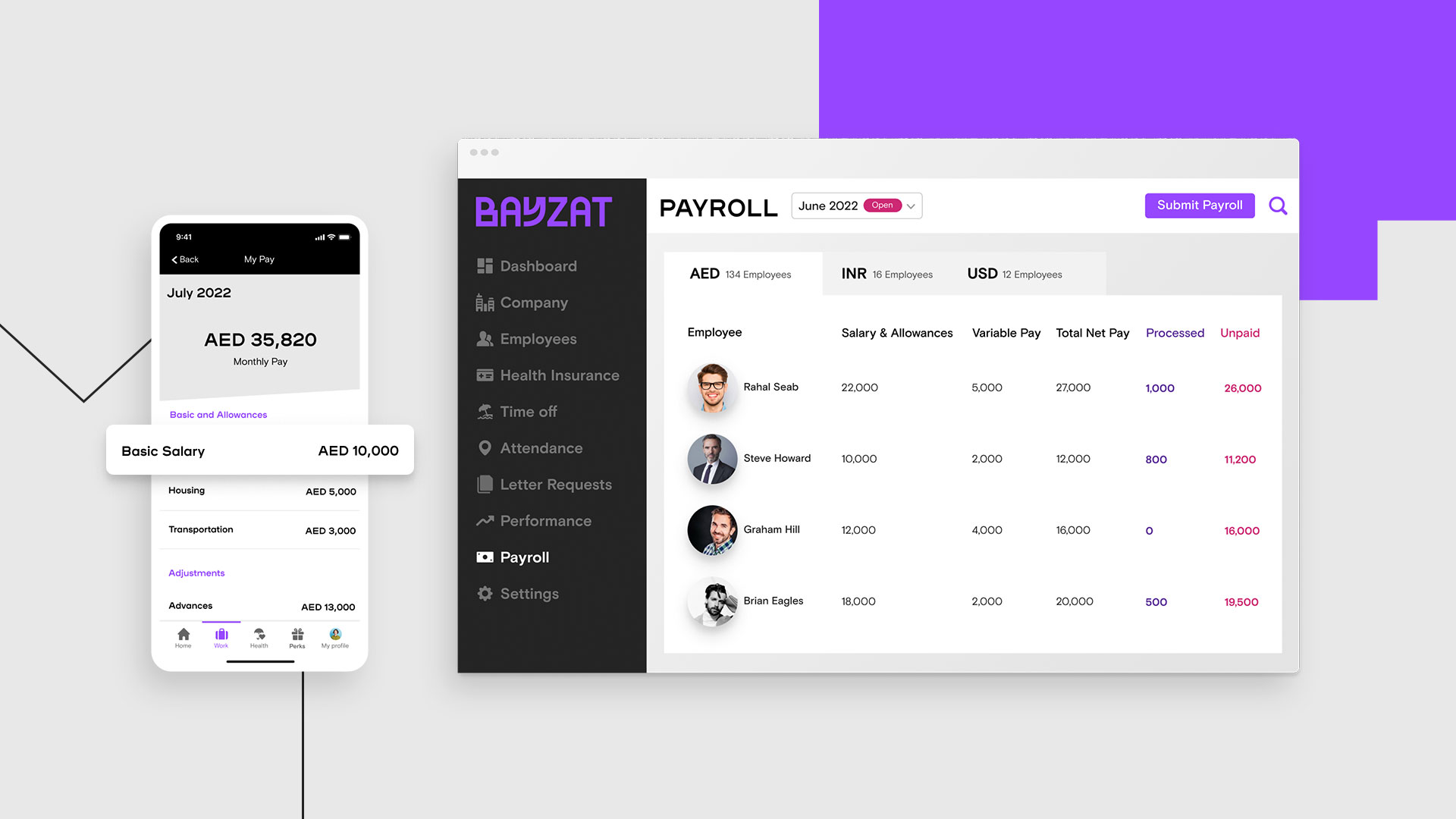

Payroll management can take a lot of time. You need to process the hours, special time-off, work-related expenses and many more for various workers, from part-time to full-time. In the […]

Employee engagement has exploded in recent years in terms of importance. But the word isn’t a meaningless buzzword. With the correct type of employee engagement, you could achieve higher productivity, […]

A coaching culture is vital for businesses in the UAE looking to increase retention. The region is notorious for having low retention rates, but a comprehensive coaching culture could change […]

Every manager and CEO knows that people make businesses succeed or fail. But managing employee performance is still too often an afterthought. In reality, if you want to make the […]

People are your most powerful asset. Employees that are happy and content at work can perform better. As your workforce becomes more productive, your business will benefit. But how can […]

Ramadan 2023: five tips for HR Upon the first sighting of the crescent moon, millions of Muslims worldwide will observe a holy month of fasting, prayer, and introspection in celebration […]

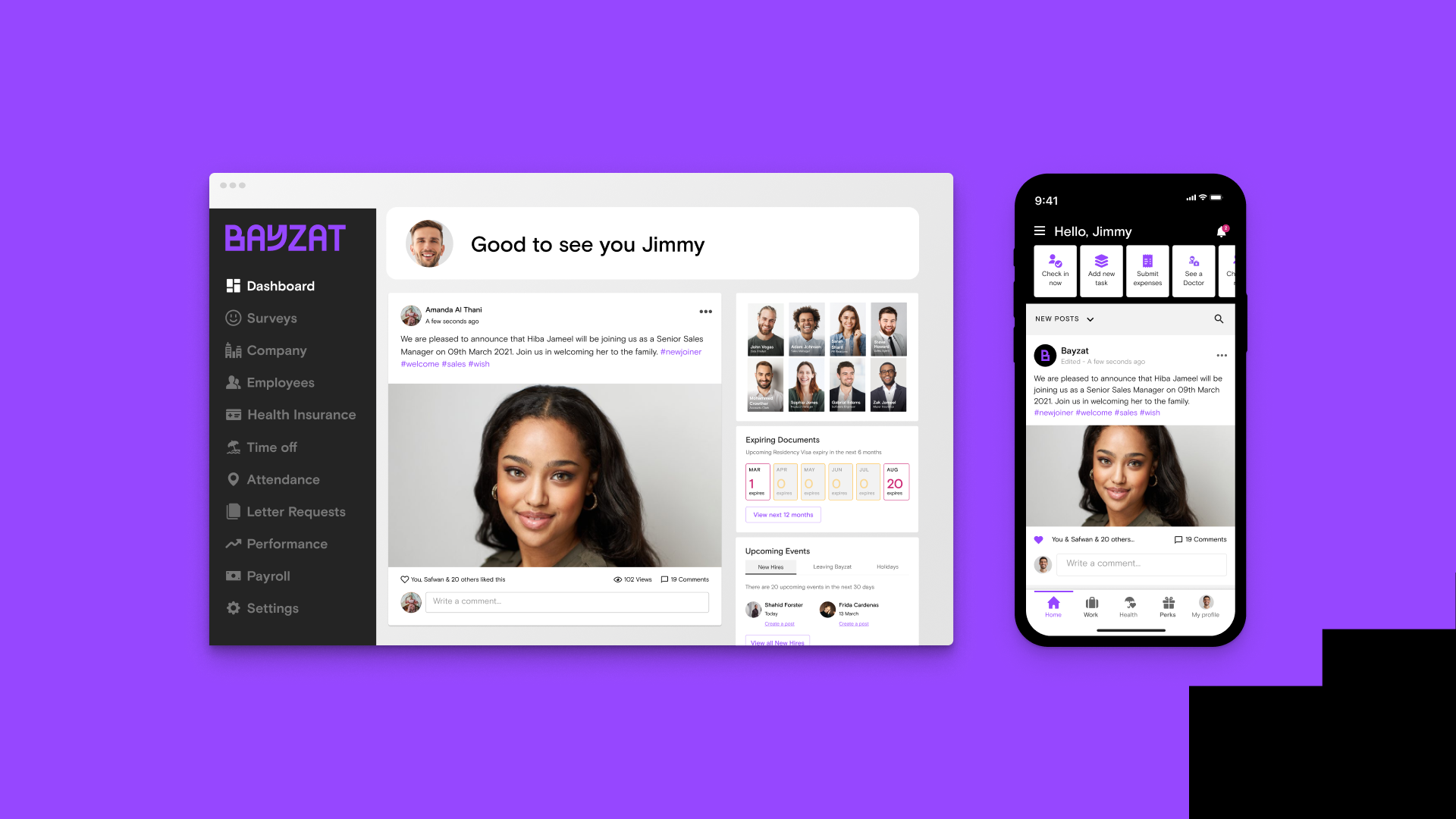

HR management involves a lot of tasks, from finding new talent to ensuring current employees are looked after. It’s a lot of paperwork and communication with different players within an […]

A company hoping to succeed must have properly mapped out goals and the right talents to achieve them. This particular reason is why businesses must prioritize proper employee management by […]

UAE has implemented changes in its employment labour law, which will take effect in 2024. The new labor law ensures dutiful and healthy employment relationships. It was adapted to guarantee […]

The UAE is a center of business; as the number of employees grows, managing HR and payroll procedures becomes a real challenge. As per an Arabian Business report, some of […]

Feeling overwhelmed by HR paperwork and endless emails? Could you access your work information and manage tasks on your own time? If so, you’re not alone. Fortunately, many companies are […]

HR managers and recruiters face significant challenges when it comes to finding the right person for a new job opening. The success of future projects depends heavily on the quality […]

In 2024, the global market for HR Tech Startups was calculated to have a value of USD 23,179.2 million, and estimates suggest that the market will grow to over USD […]

Recent years have seen a rapid transformation in evolution and growth that has changed the UAE business landscape altogether. Rising inflation, AI tools taking hold, unpredictable market trends, and ever-changing […]

In the UAE, obtaining a Medical Certificate for Sick Leave is more than a bureaucratic step. It’s a critical aspect of managing your health and work-life balance. This article aims […]

Every company wants to secure the best talent to drive its operations and innovations forward, especially in today’s competitive business environment. In the UAE, this quest for top talent is […]

HR Business Partners are one of the most sought-after professionals by UAE big firms. The strategic role has become increasingly indispensable in recent years, with its average remunerations also improving. […]

Applicant Tracking Systems (ATS) has been around since the 1990s, helping organizations and companies employ workers for relevant job openings. The emergence of ATS software in the 2000s made the […]

We are in an era of rapid technological advancements. Every workplace is experiencing a massive shift, and with the entry of generative AI, automation and AI integration are faster than […]

When hiring new employees, every role within an organization calls for a unique blend of different competencies. These could be anything from hard skills to soft skills, and behavariol attributes […]

As an HR professional, you are constantly faced with a range of tasks and responsibilities that can sometimes feel like an ever-expanding monster. Urgent tasks pile up, demanding immediate attention, […]

Payroll management can take a lot of time. You need to process the hours, special time-off, work-related expenses and many more for various workers, from part-time to full-time. In the […]

Employee engagement has exploded in recent years in terms of importance. But the word isn’t a meaningless buzzword. With the correct type of employee engagement, you could achieve higher productivity, […]

A coaching culture is vital for businesses in the UAE looking to increase retention. The region is notorious for having low retention rates, but a comprehensive coaching culture could change […]

Every manager and CEO knows that people make businesses succeed or fail. But managing employee performance is still too often an afterthought. In reality, if you want to make the […]

People are your most powerful asset. Employees that are happy and content at work can perform better. As your workforce becomes more productive, your business will benefit. But how can […]

Ramadan 2023: five tips for HR Upon the first sighting of the crescent moon, millions of Muslims worldwide will observe a holy month of fasting, prayer, and introspection in celebration […]

HR management involves a lot of tasks, from finding new talent to ensuring current employees are looked after. It’s a lot of paperwork and communication with different players within an […]

A company hoping to succeed must have properly mapped out goals and the right talents to achieve them. This particular reason is why businesses must prioritize proper employee management by […]

UAE has implemented changes in its employment labour law, which will take effect in 2024. The new labor law ensures dutiful and healthy employment relationships. It was adapted to guarantee […]

The UAE is a center of business; as the number of employees grows, managing HR and payroll procedures becomes a real challenge. As per an Arabian Business report, some of […]

Feeling overwhelmed by HR paperwork and endless emails? Could you access your work information and manage tasks on your own time? If so, you’re not alone. Fortunately, many companies are […]

HR managers and recruiters face significant challenges when it comes to finding the right person for a new job opening. The success of future projects depends heavily on the quality […]

In 2024, the global market for HR Tech Startups was calculated to have a value of USD 23,179.2 million, and estimates suggest that the market will grow to over USD […]

Recent years have seen a rapid transformation in evolution and growth that has changed the UAE business landscape altogether. Rising inflation, AI tools taking hold, unpredictable market trends, and ever-changing […]

In the UAE, obtaining a Medical Certificate for Sick Leave is more than a bureaucratic step. It’s a critical aspect of managing your health and work-life balance. This article aims […]

Get Social