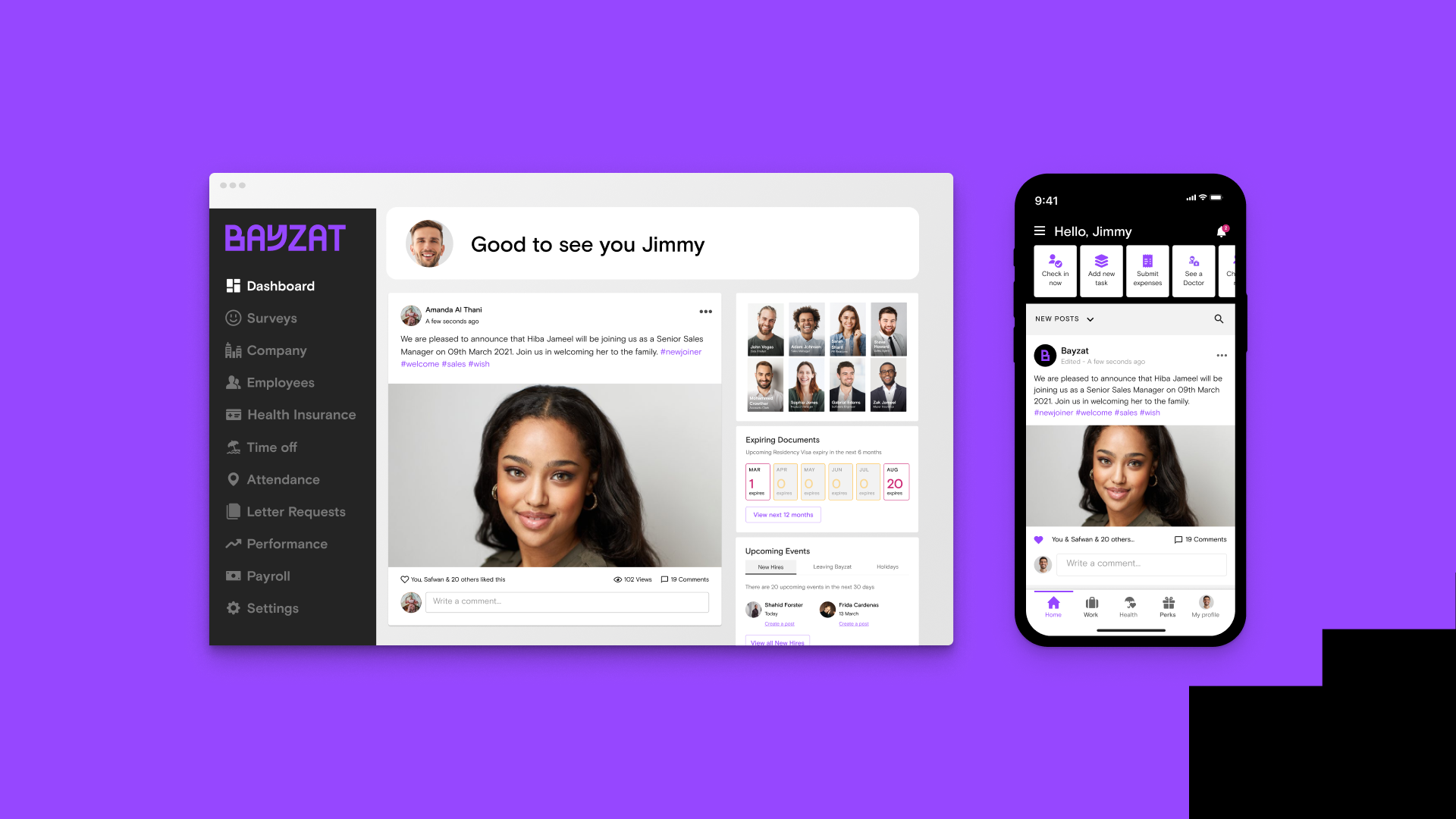

What is the Talent Lifecycle? The 5 Stages Explained

A company hoping to succeed must have properly mapped out goals and the right talents to achieve them. This particular reason is why businesses must prioritize proper employee management by exploiting the talent lifecycle model [...]

Most Read

Employee Benefits, Employee Experience

Get Social