What Is the Best HR Software? Comprehensive Comparison

What is the Best HR Software for UAE Businesses? For modern businesses in the United Arab Emirates (UAE), HR software has become an essential tool. In an era of digital transformation, HR departments face an [...]

Most Read

In the Early 2000s, General Electric, an American Multinational conglomerate, experienced a crunching profit decline and stagnant stock prices. The company had to devise a performance review process that evaluated […]

Absenteeism is a crucial aspect of every workspace and impacts company culture. Some absences are avoidable, such as illness and emergencies. However, frequent absences can affect a company’s productivity and […]

Since its release in 2022, ChatGPT has quickly become one of the most widely used AI chatbot tools worldwide. One month after its launch, it set a new record by […]

It seems like every day, there’s a new development in the world of artificial intelligence (AI). But unlike many other trends, the buzz around AI is likely justified. This is […]

Attracting the best talents in the UAE has become a rat race as many companies’ HR seek to outsmart each other. Every firm is constantly strategising to attract the most […]

So much has changed over the past few years. The whirlwind of artificial intelligence (AI) advancements has transformed different human resources operations and performance management is no exception. Integration of […]

Every company wants to secure the best talent to drive its operations and innovations forward, especially in today’s competitive business environment. In the UAE, this quest for top talent is […]

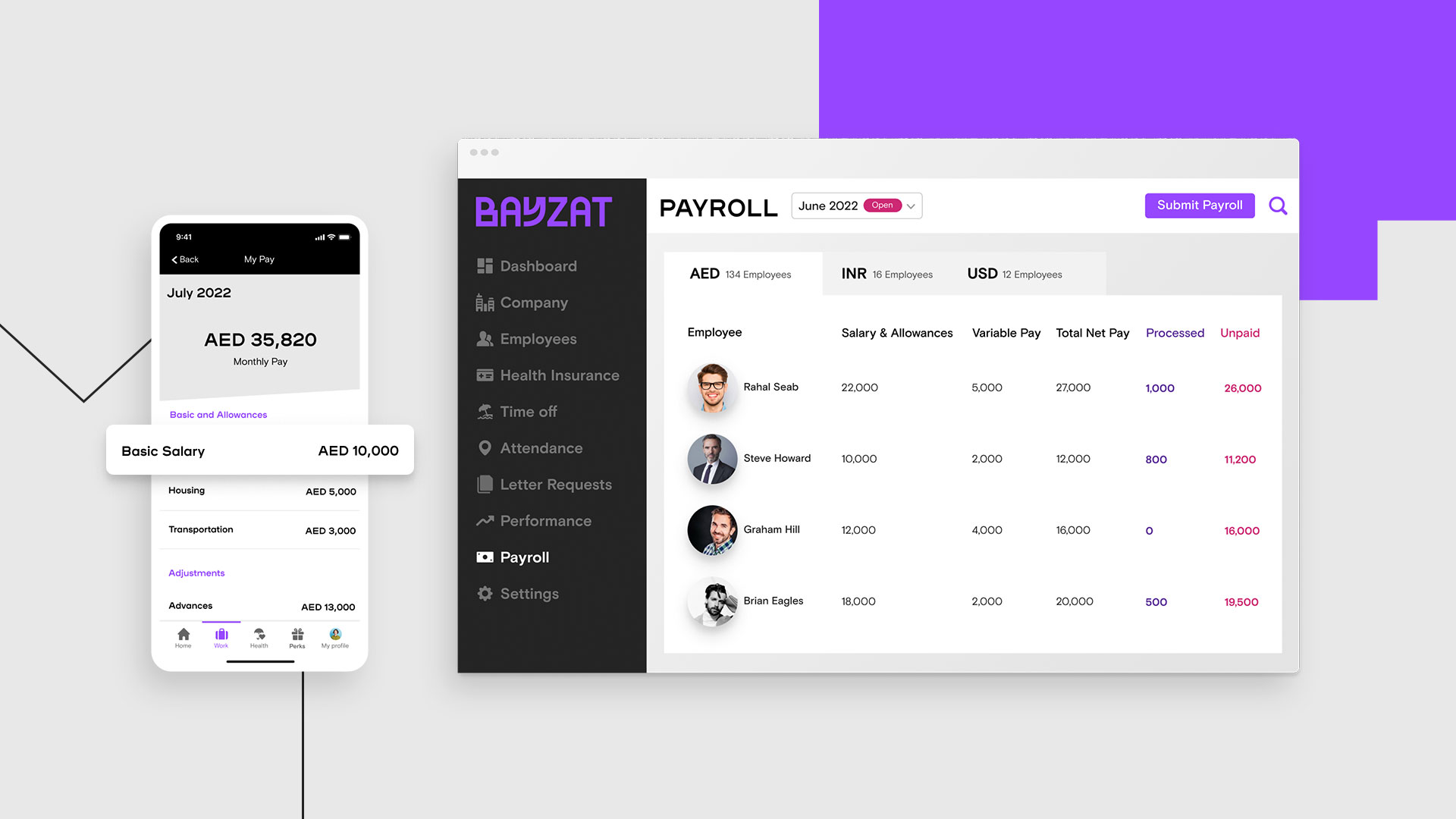

Payroll management can take a lot of time. You need to process the hours, special time-off, work-related expenses and many more for various workers, from part-time to full-time. In the […]

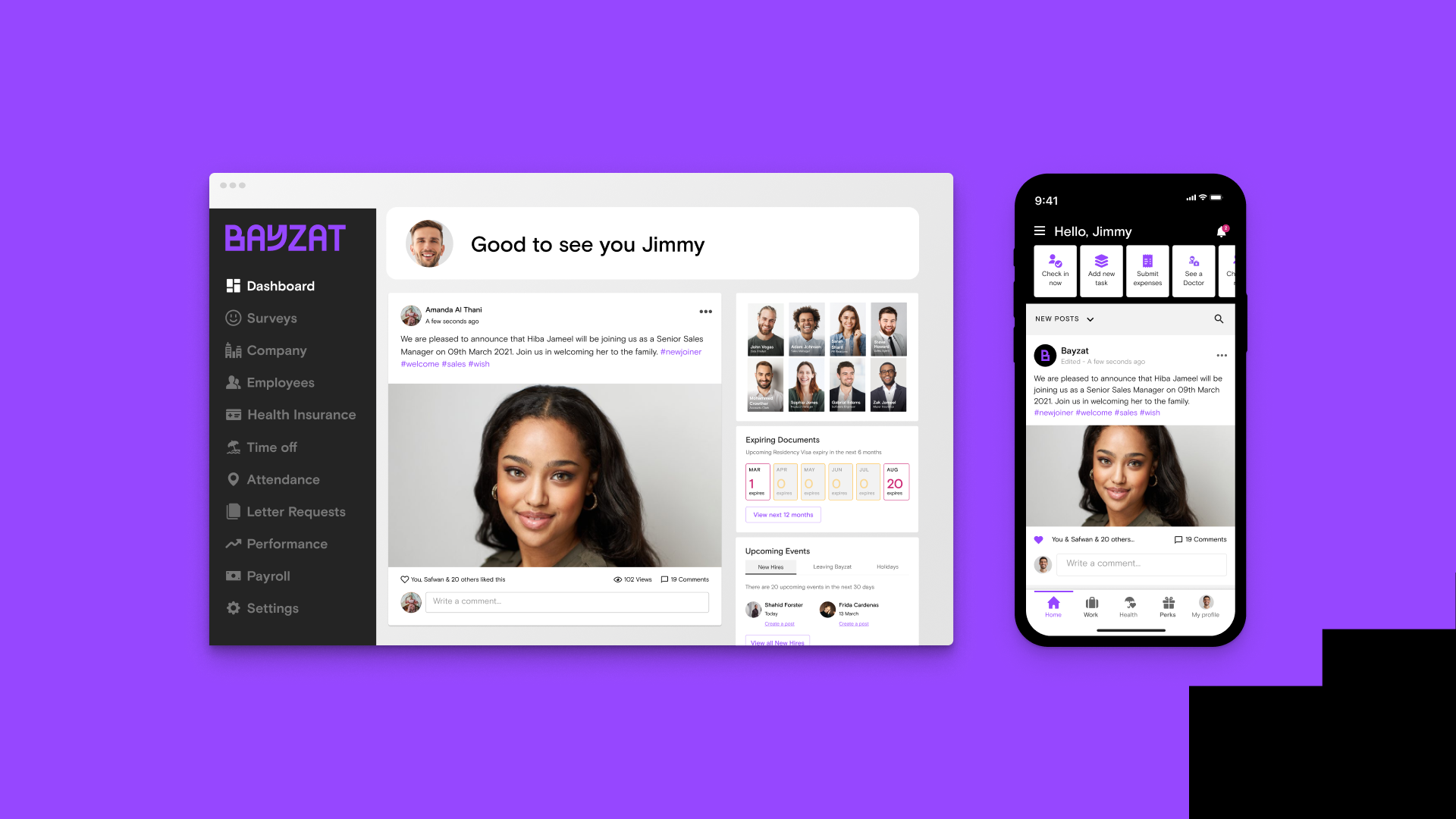

Employee engagement has exploded in recent years in terms of importance. But the word isn’t a meaningless buzzword. With the correct type of employee engagement, you could achieve higher productivity, […]

A coaching culture is vital for businesses in the UAE looking to increase retention. The region is notorious for having low retention rates, but a comprehensive coaching culture could change […]

Every manager and CEO knows that people make businesses succeed or fail. But managing employee performance is still too often an afterthought. In reality, if you want to make the […]

People are your most powerful asset. Employees that are happy and content at work can perform better. As your workforce becomes more productive, your business will benefit. But how can […]

HR management involves a lot of tasks, from finding new talent to ensuring current employees are looked after. It’s a lot of paperwork and communication with different players within an […]

What is the Best HR Software for UAE Businesses? For modern businesses in the United Arab Emirates (UAE), HR software has become an essential tool. In an era of digital […]

Need an efficient way to handle employee onboarding process? Our onboarding and offboarding checklist offers clear steps for smooth integration of new hires and professional exits. Discover best practices in […]

Accounts Payable is the process of tracking, managing, and paying vendor invoices. Every business, big or small, has to deal with Accounts Payable (AP) but if done manually, AP can […]

Understanding HR policies in UAE is crucial for legal compliance and efficient operations. This guide provides insights into essential HR policies in UAE on recruitment, compensation, performance management, and legal […]

A multi-generational workforce has merits and demerits. Knowing how to engage such dynamism can push your organization to unprecedented growth levels, while the opposite could lead to a total collapse. […]

One common challenge UAE start-ups face is scaling their culture and imprinting the idea into talents to achieve overall goals. A company’s culture is like its DNA, defining how it […]

Attracting the best talent and holding onto the existing top performers means the company will need to have an attractive compensation package within its staff retention and hiring plan. Sometimes […]

“The recruitment process in the UAE is so slow. It’s just very slow, unfortunately. It’s indecision in the process of hiring. It’s a cultural thing. No one wants to decide […]

The rise of technology has brought about several changes in the way we learn and work. One of the most significant changes is the availability of Massive Open Online Courses […]

Upskilling refers to learning new skills or enhancing existing ones to improve an individual’s capabilities and value in the workplace. According to a recent report by the World Economic Forum, […]

In the Early 2000s, General Electric, an American Multinational conglomerate, experienced a crunching profit decline and stagnant stock prices. The company had to devise a performance review process that evaluated […]

Absenteeism is a crucial aspect of every workspace and impacts company culture. Some absences are avoidable, such as illness and emergencies. However, frequent absences can affect a company’s productivity and […]

Since its release in 2022, ChatGPT has quickly become one of the most widely used AI chatbot tools worldwide. One month after its launch, it set a new record by […]

It seems like every day, there’s a new development in the world of artificial intelligence (AI). But unlike many other trends, the buzz around AI is likely justified. This is […]

Attracting the best talents in the UAE has become a rat race as many companies’ HR seek to outsmart each other. Every firm is constantly strategising to attract the most […]

So much has changed over the past few years. The whirlwind of artificial intelligence (AI) advancements has transformed different human resources operations and performance management is no exception. Integration of […]

Every company wants to secure the best talent to drive its operations and innovations forward, especially in today’s competitive business environment. In the UAE, this quest for top talent is […]

Payroll management can take a lot of time. You need to process the hours, special time-off, work-related expenses and many more for various workers, from part-time to full-time. In the […]

Employee engagement has exploded in recent years in terms of importance. But the word isn’t a meaningless buzzword. With the correct type of employee engagement, you could achieve higher productivity, […]

A coaching culture is vital for businesses in the UAE looking to increase retention. The region is notorious for having low retention rates, but a comprehensive coaching culture could change […]

Every manager and CEO knows that people make businesses succeed or fail. But managing employee performance is still too often an afterthought. In reality, if you want to make the […]

People are your most powerful asset. Employees that are happy and content at work can perform better. As your workforce becomes more productive, your business will benefit. But how can […]

HR management involves a lot of tasks, from finding new talent to ensuring current employees are looked after. It’s a lot of paperwork and communication with different players within an […]

What is the Best HR Software for UAE Businesses? For modern businesses in the United Arab Emirates (UAE), HR software has become an essential tool. In an era of digital […]

Need an efficient way to handle employee onboarding process? Our onboarding and offboarding checklist offers clear steps for smooth integration of new hires and professional exits. Discover best practices in […]

Accounts Payable is the process of tracking, managing, and paying vendor invoices. Every business, big or small, has to deal with Accounts Payable (AP) but if done manually, AP can […]

Understanding HR policies in UAE is crucial for legal compliance and efficient operations. This guide provides insights into essential HR policies in UAE on recruitment, compensation, performance management, and legal […]

A multi-generational workforce has merits and demerits. Knowing how to engage such dynamism can push your organization to unprecedented growth levels, while the opposite could lead to a total collapse. […]

One common challenge UAE start-ups face is scaling their culture and imprinting the idea into talents to achieve overall goals. A company’s culture is like its DNA, defining how it […]

Attracting the best talent and holding onto the existing top performers means the company will need to have an attractive compensation package within its staff retention and hiring plan. Sometimes […]

“The recruitment process in the UAE is so slow. It’s just very slow, unfortunately. It’s indecision in the process of hiring. It’s a cultural thing. No one wants to decide […]

The rise of technology has brought about several changes in the way we learn and work. One of the most significant changes is the availability of Massive Open Online Courses […]

Upskilling refers to learning new skills or enhancing existing ones to improve an individual’s capabilities and value in the workplace. According to a recent report by the World Economic Forum, […]

Get Social